The economics of COVID-19 on health care providers, payers and life sciences companies has been well documented and stated.

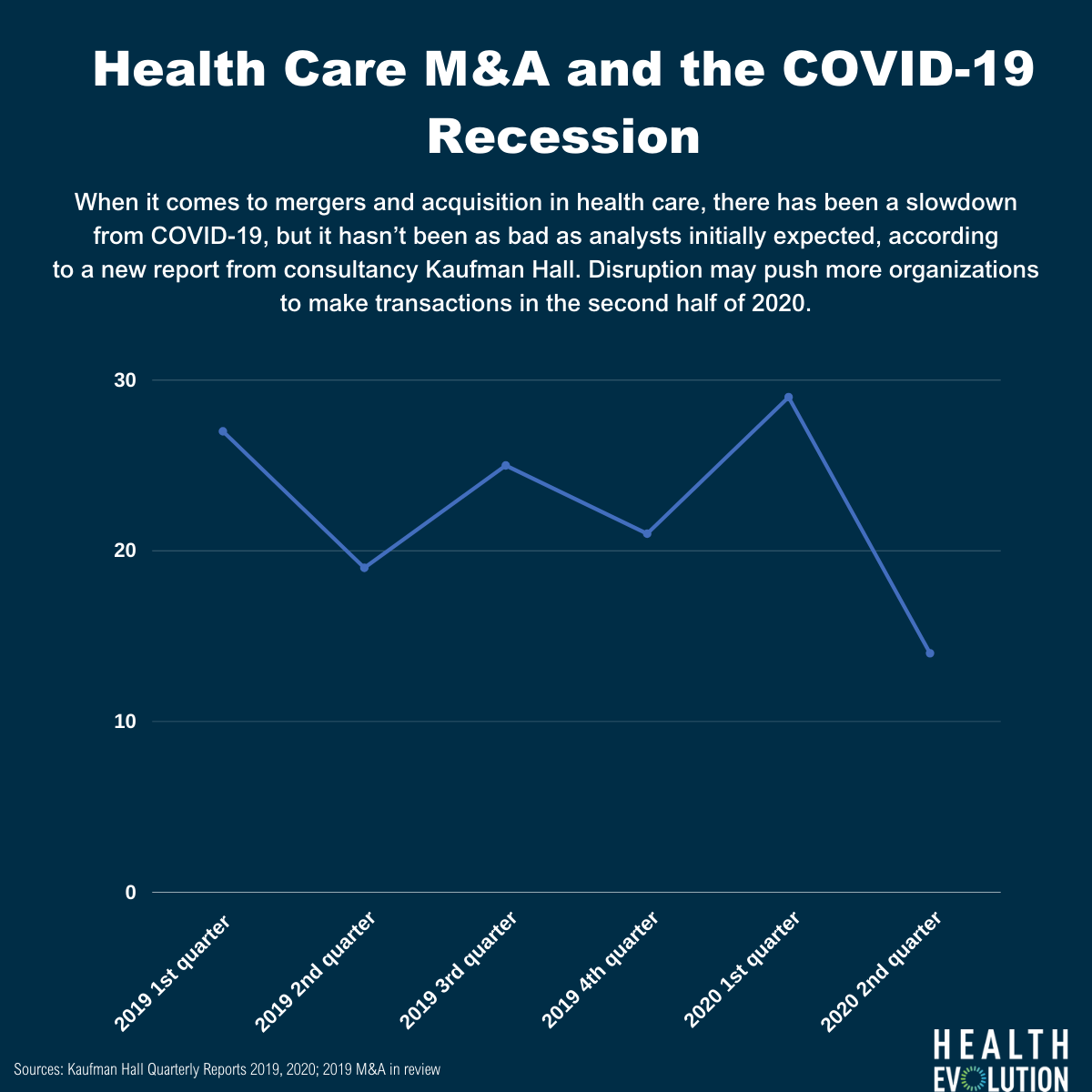

Yes, things are bleak in many corners of the health system. And when it comes to mergers and acquisition, there has been a slowdown from COVID-19, but it hasn’t been as bad as analysts initially expected, according to a new report from consultancy Kaufman Hall.

In quarter two of 2020, there were 14 transactions announced. While this represents a slowdown from the prior quarter, with 29 transactions, it is not a significant change year-over-year from Q2 2019, when 19 transactions were announced.

Read more: Health Evolution announces Innovation Lab

Moreover, the authors say the quarter saw one of the highest figures for average size of seller by revenue the consultancy has ever recorded, at more than $800 million. Total transacted revenue for the quarter was also high at $12 billion—thanks in large part to the merger of Advocate Aurora Health’s proposed merger with Beaumont Health and Steward Health Care’s acquisition by a group of affiliated physicians.

“We believe the COVID-19 crisis has only strengthened the health care industry’s imperative for transformation. We anticipate that we will see more discussions that began pre-pandemic moving to definitive agreements or closure in the remaining quarters of the year,” Kaufmann Hall says in the report.

Other sectors of health care

Other sectors of the health care industry have also not seen a significant drop off in M&A activity thanks to COVID-19. A report from health care services M&A firm Mertz-Taggart says that the pandemic has not been detrimental to M&A activity in the home care industry.

Furthermore, a report from JD Supra, looking at deals in the pharma, medical and biotech space say that while activity fell overall, private equity firms and corporations continue to pursue deals. The pharma industry in particular was active in Q2, with deals between Alexion Pharmaceuticals and Portola Pharmaceuticals.

“Most health care companies have weathered the financial fallout of the COVID-19 crisis. The resources and interest in deals are in place to support transactions across the sector during the second half of the year,” the authors of the JD Supra report write.

Digital health too

There’s not only optimism in the M&A space—but investments in digital health have seen an uptick in the first half of 2020 compared to last year, according to a report from Mercom. There was a total of $6.3 billion in new digital health investments in the first half of 2020, which was 24% higher compared to $5.1 billion raised the first half of 2019. Venture funding reached $2.8 billion during Q2 2020, Mercom says, an 11% decrease year-over-year compared to $3.1 billion raised in Q2 2019. Not surprisingly, the top funded category was telehealth with $1.9 billion followed by analytics ($826 million) mobile health apps ($794 million) and clinical decision support ($545 million).

“Adoption of digital health technologies and products have accelerated since the COVID-19 outbreak, which is reflected in the funding spike in the first half of the year. Telehealth hype has been backed by $2 billion in venture funding with no signs of slowing down,” said Raj Prabhu, CEO of Mercom Capital Group.

Another report, from Rock Health, also indicates that digital health funding was faring well in the post-COVID environment. According to the report, American digital health companies raised $5.4B in venture funding across the first six months of 2020.