In December 2020, Congress passed a $900 million stimulus deal that included the “No Surprises Act,” a bill that effectively aims to ban surprise medical billing. The Department of Health and Human Services (HHS) has now issued the first rule outlining how the law will be enforced and it comes at a time when consumers are aggravated with the practice and the high cost of medical bills.

The No Surprises Act requires providers to work with payers in settling a fair price to charge when out-of-network clinicians are unexpectedly thrust into a patient’s care at an in-network facility. Previously, unless it was banned by state law, out-of-network providers could charge patients for the difference paid by insurance and the billed charge.

HHS’s new interim final rule, “Requirements Related to Surprise Billing; Part I,” specifically covers emergency services, air ambulance services provided by out-of-network providers, and non-emergency services provided by out-of-network providers at in-network facilities in certain circumstances. These services must be covered without prior authorization and at a fair price, negotiated by payers and providers. The rule also limits cost sharing for out-of-network services, ensuring they can be charged no higher than in-network levels and count toward any in-network deductibles and out-of-pocket maximums.

The rule also prohibits balance billing, out-of-network charges for ancillary care (like an anesthesiologist or assistant surgeon) at an in-network facility in all circumstances and charging someone out-of-network without advance notice. As part of this provision, health care providers and facilities must provide patients with a plain-language consumer notice explaining that patient consent is required to receive care on an out-of-network basis before that provider can bill at the higher out-of-network rate.

“No patient should forgo care for fear of surprise billing,” HHS Secretary Xavier Becerra said in a statement. “Health insurance should offer patients peace of mind that they won’t be saddled with unexpected costs. The Biden-Harris Administration remains committed to ensuring transparency and affordable care, and with this rule, Americans will get the assurance of no surprises.”

The rule can be read in its 411-page entirety here. HHS is set to begin enforcement in 2022 and the agency is taking comments for the next 60 days. In particular, HHS sought guidance on striking the appropriate balance between ensuring out-of-network providers have consent from patients, while weighing what rights providers have to refuse services if patients won’t sign a consent form. Moreover, The No Surprises Act included multiple provisions that were not addressed within this rule, which means there will be future outputs from HHS in this area.

Surprise billing data

A new study from the Journal of the American Medical Association reveals how widespread the practice of surprise billing is in maternal care. Researchers at the University of Michigan Medical School looked at newborn hospitalizations in 2019 and found that nearly 20 percent had 1 or more potential surprise bill for the delivery, newborn hospitalization, or both. Those delivering birth via Caesarean section had an even higher rate of receiving a surprise medical bill, with the median cost at $1,825 ($272-$5,624).

Other data from Michigan Medical School researchers, published in February 2020, further showed the prevalence of this issue. The study found that one-in-five elective operations could result in a surprise medical bill. On average, the cost of those bills was $2,000, according to the Michigan researchers. The patients in this survey chose a surgeon who accepts their insurance, and had one of seven common, non-emergency operations at an in-network hospital or at an outpatient surgery center. These are the scenarios that the No Surprises Act is aiming to prevent.

“Even if patients do their homework before they have elective surgery, this study shows they can be at risk of receiving large bills they never expected, from providers they never met or even knew about,” Karan Chhabra, MD, National Clinician Scholar at the University of Michigan Institute for Healthcare Policy and Innovation, said in response to the February 2020 study.

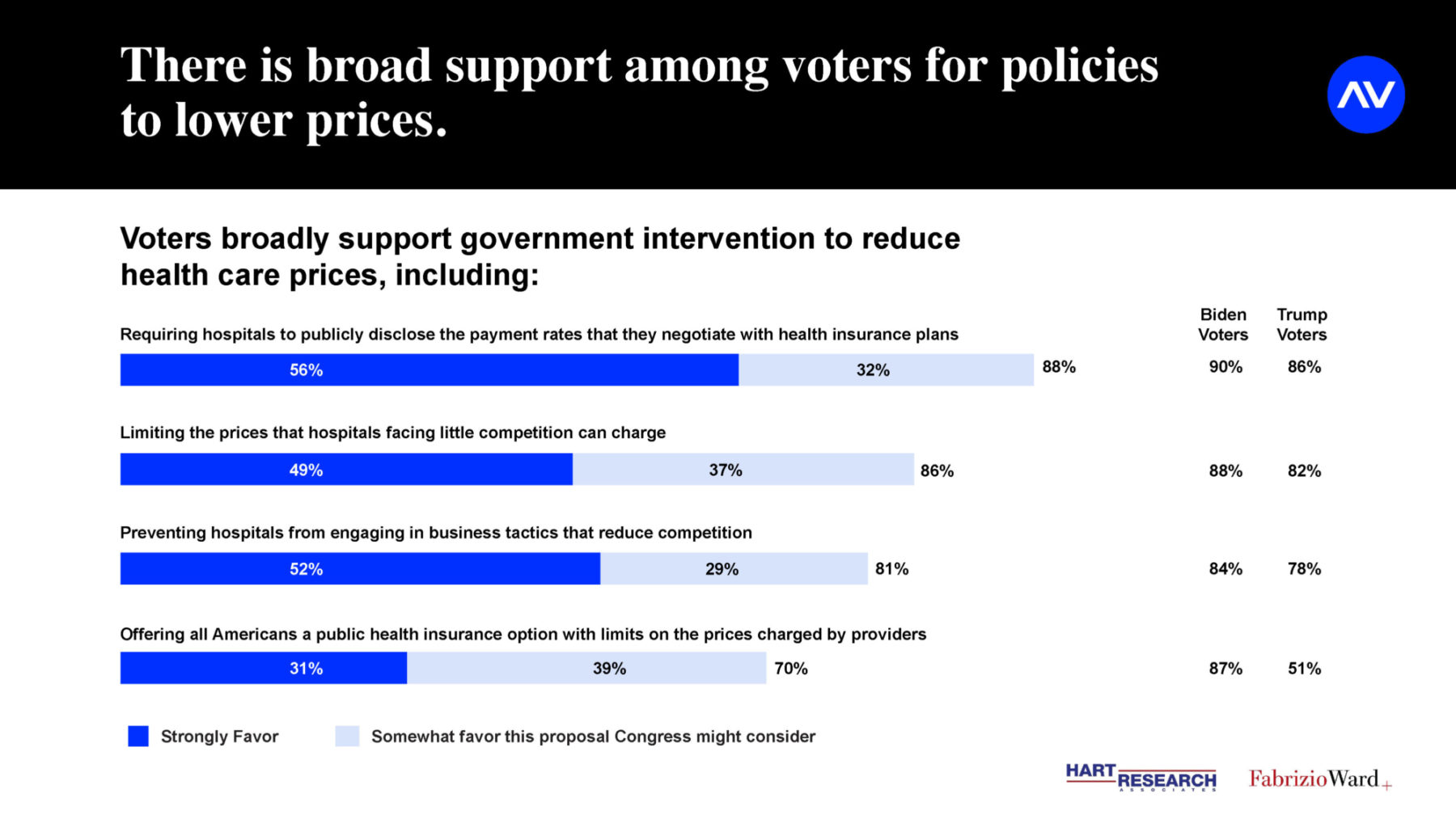

A new survey from Arnold Ventures, Hart Research Associates and Fabrizio Ward shows how getting rid of these high-cost surprise medical bills and lowering health costs has bipartisan support. The researchers found that 78 percent of potential voters support government limits on the prices that hospitals can charge. Overall, more than two-thirds of voters (67 percent) rank reducing health care costs as their top priority for the President and Congress. More voters (64 percent) are concerned that Congress won’t do enough to limit prices than are worried Congress will get involved in setting prices (36 percent). Nine out of 10 voters say it is important for this Congress to take action to reduce health care prices, 64 percent say it is very important, including nearly 4 out of 5 Biden voters (78 percent) and half of Trump voters (49 percent).

See image above for more data on consumer preferences on health care pricing

A November 2020 survey from the American Heart Association and Harris showed the fear patients have for the high cost of medical bills. Nearly half (49 percent) of U.S. adults in that survey say that unexpected medical bill keeps them from seeking care, and a similar proportion (44 percent) say if they received an unexpected medical bill for $1,000 they would not have the money to pay for it. In that same survey, 68 percent of patients say they have received at least one surprise medical bill.

Initial reactions are mixed

The rule from HHS received mixed reactions from the various industry stakeholders, but one area where it has found universal support is with patients and consumers. The patient advocacy group Action for Health, for example, said the ruling was a good first step in stopping insurers’ from denying payments for medically necessary services. The group says the ruling spends a lot of time calculating costs and encourages HHS to create a fair independent dispute resolution (IDR) process in future rulings, which is important to making the whole No Surprises Act law work effectively.

Another patient group, the Coalition Against Surprise Medical Billing, said that the guidance reinforces the law’s important protections for patients facing medical emergencies, including situations where notice and consent procedures would not apply so that patients don’t become victims of a surprise bill at their most vulnerable moments. “Moving forward, we urge the Administration to provide consumers with meaningful cost-savings and protection against surprise medical bills by reinforcing the importance of the qualified payment amount for final payment determinations and limiting potential abuse and misuse of arbitration by out-of-network providers and private equity firms,” the coalition said in a statement.

From the industry side, payers and providers are pointing the finger at each other as to why the No Surprises Act may not work. The American Hospital Association asked HHS to “carefully reconsider some aspects of the rule that could create a financial windfall for insurers while financially destabilizing providers and thus removing access points for patients without any guarantee that the savings are passed on to consumers.”

Insurer trade groups, such as America’s Health Insurance Plans (AHIP), have not released any statements in reaction to the HHS rule. However, when the No Surprises Act passed in December, the group suggested that “private-equity firms will continue to find ways to exploit the arbitration process to price gouge patients and raise health care costs for everyone.” Back in January, Justine Handelman, Blue Cross Blue Shield Association’s senior vice president of the office of policy and representation, said: “We remain concerned that a complex arbitration process, which has been ineffective in states that have tried it, holds the potential to raise premiums for everyone.”

Employer groups, such as Purchaser Business Group on Health (PBGH), have made similar comments to Action for Health. In a letter to Becerra and Labor Secretary Marty Walsh, PBGH wrote: “It is vital that your agencies implement the No Surprises Act consistent with Congressional intent and to the clear benefit of consumers and payers – by ensuring that the implemented law reduces health care costs overall, and minimizes the ability of providers to demand above-market rates for services in surprise billing situations.