No matter how you slice it, 2021 was a record-breaking year for digital health.

According to a report from CB Insights, global funding for the digital health sector grew 79 percent year over year to reach a record $57.2 billion. The report found that the number of funding deals worth more than $100 million nearly doubled to 154 from 2020. In total, CB Insights says that the year produced 85 new unicorns in the digital health space, which was a new record.

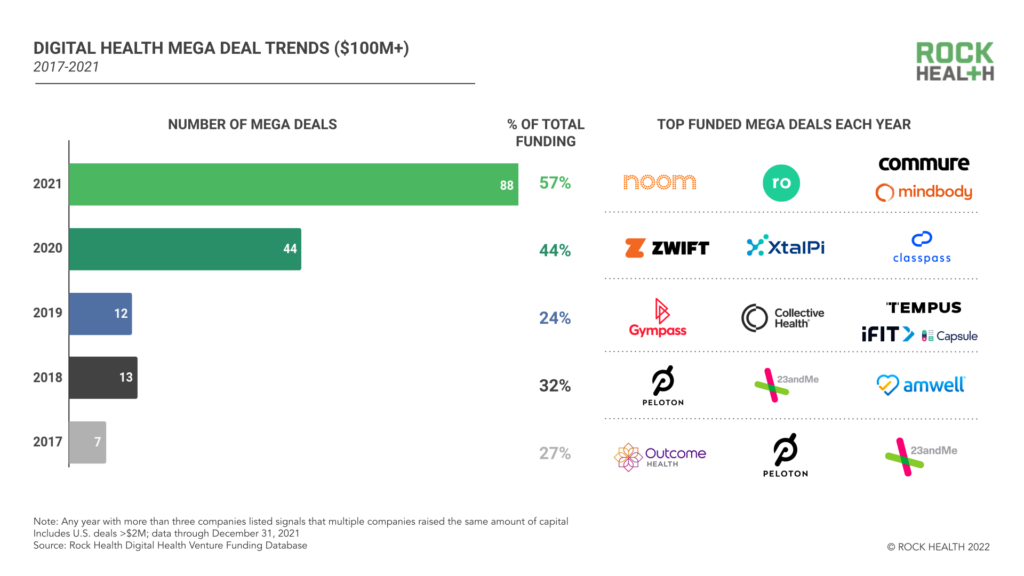

Rock Health said that the total funding in the U.S. for digital health companies was nearly $30 billion, an increase of nearly double from 2020’s $14.9 billion. According to Rock Health, 2021 saw four of the five largest digital health deals since the company started tracking these investments in 2011: Noom ($540M), Ro ($500M), Mindbody ($500M), and Commure ($500M).

Photo Credit: Rock Health

Rock Health noted that top category for digital health investments in 2021 was mental health. Those in the mental health space raised $5.1 billion, which is more than $3 billion than any other clinical area. Beyond those areas were cardiovascular ($1.8 billion) and diabetes ($1.8 billion). Musculoskeletal digital health funding grew six-fold from $200 million to $1.4 billion. According to CB Insights, funding for mental health digital startups grew 139 percent globally year over year.

Justin Norden, MD and Sunny Kumar, MD, partners at GSR Ventures, a venture capital firm that has specialized in digital health have watched the funding boom from the front row. Earlier in their careers, the physicians-turned-investors saw the potential transformational impact that digital health could have in improving health care. Since joining GSR in 2017 (Kumar) and Norden (2019), funding has exploded.

“If you zoom out, less than a decade ago there was only $2 billion going into digital health from a venture perspective. According to Rock Health, it was nearly $30 billion last year. That’s a sizable increase in the last few years,” Kumar says. “There are new people coming into the digital health ecosystem, which is fantastic. It gives more perspectives from people who aren’t historically health care investors.”

Digital health funding trends in 2022

A trend to watch in the digital health space will be consolidation. CB Insight’s report found that there were 574 M&A deals across the globe among digital health companies in 2021, an increase of 44 percent from last year. This includes Best Buy’s acquisition of Current Health for $400 million, 23andMe’s acquisition of Lemonaid for $400 million and Claroty’s acquisition of Medgate for $400 million.

Along with the record M&A numbers, 23 digital health companies went public via SPAC or IPO in 2021, almost triple the previous peak of eight in 2020. Norden says that private digital health investment will continue to thrive in 2022, but he expects there will be some leveling off and more exits as more companies look for an off ramp.

“If you look at what’s happened with the public digital health companies, there’s been a huge decrease in valuation. There was initial excitement in 2020 with COVID and telehealth adoption, but then there’s been a reality check. Some of these companies are losing money and there’s been a huge correction on the public side,” Norden says.

To this point, Castlight Health, one of the first digital health companies to go public recently went private through a deal with Vera Health. Castlight went public in 2014 at $16 per share but has since dropped 95 percent. Norden expects private investors to eventually level off the funding in response to these challenges on the public market.

How to navigate the digital health market

The burgeoning—and potentially tumultuous— digital health market is going to be a challenge for health care CEOs to navigate, particularly as companies go public or private, receive massive funding rounds and merge with other players in the field. Norden and Kumar say that the focus in investments should always be on value.

“At the end of the day, you have to create value. There are a lot of ways to generate revenue, but if you’re not creating value, you’re not really creating something sustainable. That needs to be your north star,” says Kumar. He says that health systems and payers have no choice but to adopt these solutions if they want to give patients the best service and stay viable. “The challenge is that it’s really hard to pick which solution should I use out of the hundreds that are out there today.”

Kumar says that there needs to be a governing body that can help deliver information on different digital health solutions in an unbiased manner.

For digital health CEOs, Kumar advises that they shouldn’t be hasty about going public. “What we saw in the last 18 months, many companies went public too early before they had their business model truly ironed out, before they had the predictability of quarterly earnings. There should be no rush to go public. Make sure you take the time to get things right first,” Kumar says.